What Does San Diego Home Insurance Mean?

What Does San Diego Home Insurance Mean?

Blog Article

Secure Your Satisfaction With Reliable Home Insurance Plans

Why Home Insurance Policy Is Necessary

The significance of home insurance policy hinges on its capacity to give economic defense and assurance to home owners in the face of unanticipated events. Home insurance coverage works as a safeguard, offering insurance coverage for damages to the physical framework of the home, individual possessions, and responsibility for accidents that might take place on the residential property. In the event of all-natural disasters such as fires, floods, or earthquakes, having a thorough home insurance policy can assist homeowners recover and reconstruct without facing substantial financial burdens.

Furthermore, home insurance coverage is commonly called for by mortgage lending institutions to safeguard their investment in the home. Lenders wish to ensure that their monetary interests are protected in case of any type of damage to the home. By having a home insurance coverage in place, homeowners can fulfill this demand and secure their financial investment in the property.

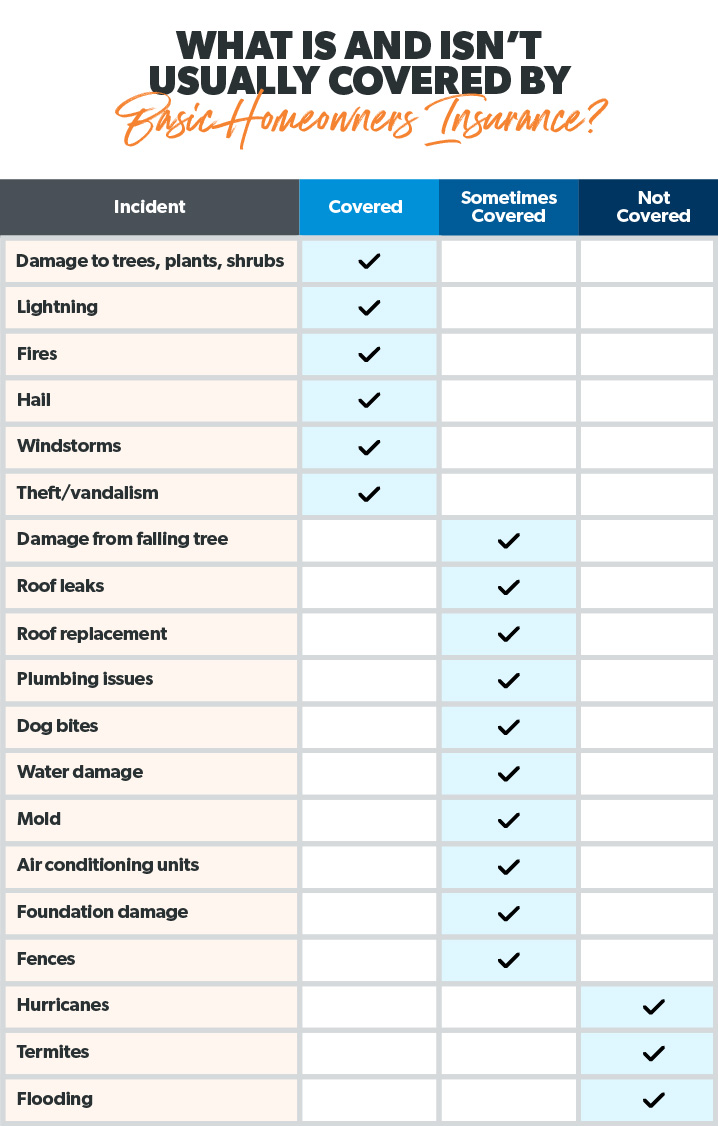

Kinds Of Coverage Available

Offered the importance of home insurance policy in protecting property owners from unanticipated financial losses, it is important to comprehend the different types of insurance coverage available to customize a plan that suits specific needs and circumstances. There are a number of key kinds of protection provided by most home insurance policies. Personal property protection, on the various other hand, safeguards belongings within the home, consisting of furnishings, electronics, and apparel.

Variables That Effect Premiums

Aspects affecting home insurance coverage costs can differ based on a series of factors to consider certain to individual situations. One considerable variable influencing costs is the location of the insured home. Residences in areas prone to all-natural calamities such as hurricanes, quakes, or wildfires generally attract greater costs due to the raised threat of damage. The age and condition of the home additionally play an important role. Older homes or residential properties with obsolete electrical, plumbing, or home heating systems may position higher risks for insurer, resulting in greater premiums.

In addition, the insurance coverage restrictions and deductibles picked by the policyholder can influence the costs amount. Going with greater protection restrictions or lower deductibles generally results in greater costs. The sort of building products utilized in the home, such as timber versus block, can also influence costs as particular materials might be much more prone to damage.

How to Choose the Right Policy

Selecting the appropriate home insurance plan includes careful factor to consider of various vital facets to guarantee extensive coverage customized to specific requirements and scenarios. To begin, analyze the value of your home and its materials accurately. Next, think about the different types of insurance coverage available, such as dwelling coverage, personal home protection, liability protection, and extra living costs protection.

Additionally, assessing the insurance coverage company's credibility, monetary stability, customer service, and claims procedure is crucial. By carefully examining these aspects, you can pick a home insurance policy that provides the needed defense and tranquility of mind.

Advantages of Reliable Home Insurance Coverage

Reputable home insurance provides a feeling of safety and security and protection for home owners versus unpredicted occasions and monetary losses. One of the key advantages of trusted home insurance coverage is the assurance that your residential or commercial property will certainly be covered in case of damages or destruction created by natural disasters such as floodings, fires, or tornados. This protection can aid property owners stay clear of bearing the complete expense of fixings or rebuilding, providing satisfaction and financial security during challenging times.

In addition, reputable home insurance plans usually include obligation protection, which can secure home owners from Homepage medical and lawful expenses when it comes to accidents on their property. This protection expands beyond the physical structure of the home to safeguard versus suits and insurance claims that might occur from injuries endured by site visitors.

Furthermore, having trustworthy home insurance policy can also add to a feeling of overall wellness, knowing that your most considerable financial investment is guarded versus numerous risks. By paying regular premiums, property owners can minimize the possible financial concern of unanticipated occasions, permitting them to concentrate on appreciating their homes without consistent bother with what may occur.

Final Thought

In conclusion, securing a dependable home insurance coverage plan is vital for safeguarding your residential or commercial property and possessions from unanticipated occasions. By understanding the kinds of protection offered, elements that influence premiums, and how to select the right plan, you can ensure your comfort. Relying on a reliable home insurance policy company will use you the benefits of monetary protection and safety for your most valuable possession.

Navigating the realm of home insurance can be complicated, with various protection alternatives, policy factors, and considerations to weigh. Understanding why home insurance policy is vital, the kinds of coverage offered, and how to select the ideal policy can be critical in guaranteeing your most significant investment continues to be safe.Offered the significance of home insurance coverage in protecting house owners from unanticipated financial losses, it is vital to recognize the various types of insurance coverage readily available to find more info tailor a policy that fits specific requirements and scenarios. San Diego Home Insurance. There are numerous key types of insurance coverage offered by a lot of home insurance policy plans.Selecting the proper home insurance coverage policy involves cautious factor to consider of various essential elements to make certain extensive coverage customized to private needs and circumstances

Report this page